The Ultimate Guide to Equity Financing

.jpeg)

With stock markets trading close to record highs, now is a good time for companies to consider equity financing, even if they’re not publicly listed.

The average trading multiple on the S&P 500 is currently above 34, near the highest level it has been in a decade. All things being equal, that means that investors, on average, are overpaying for equity investments.

On the flip side, this represents a massive opportunity for companies looking to raise funds through equity financing.

Equity financing has many parallels to debt financing, although tends to bring more complications for the company raising funds in the long-term.

DealRoom regularly works with these companies, many of which are using equity to fund large M&A transactions. Our research indicates that of the 10 largest industry transactions (i.e. not involving private equity) in this decade, all involved some form of equity financing.

Hence, equity financing is of paramount importance to M&A. This is the DealRoom overview of the process.

What is Equity Financing?

Equity financing is the process through which capital is raised through the sale or exchange of shares. When capital is raised through the sale of shares, it implies that a third party acquires a pre-agreed amount of shares in the business in exchange for cash.

When there is an exchange of equity, as is the case with many M&A transactions, the third party accepts equity in the company in lieu of cash for their own company’s equity.

In both cases, the company is relinquishing some control in the company to the third party through the equity financing.

Listen to private equity podcasts to improve your knowledge on equity financing in general works.

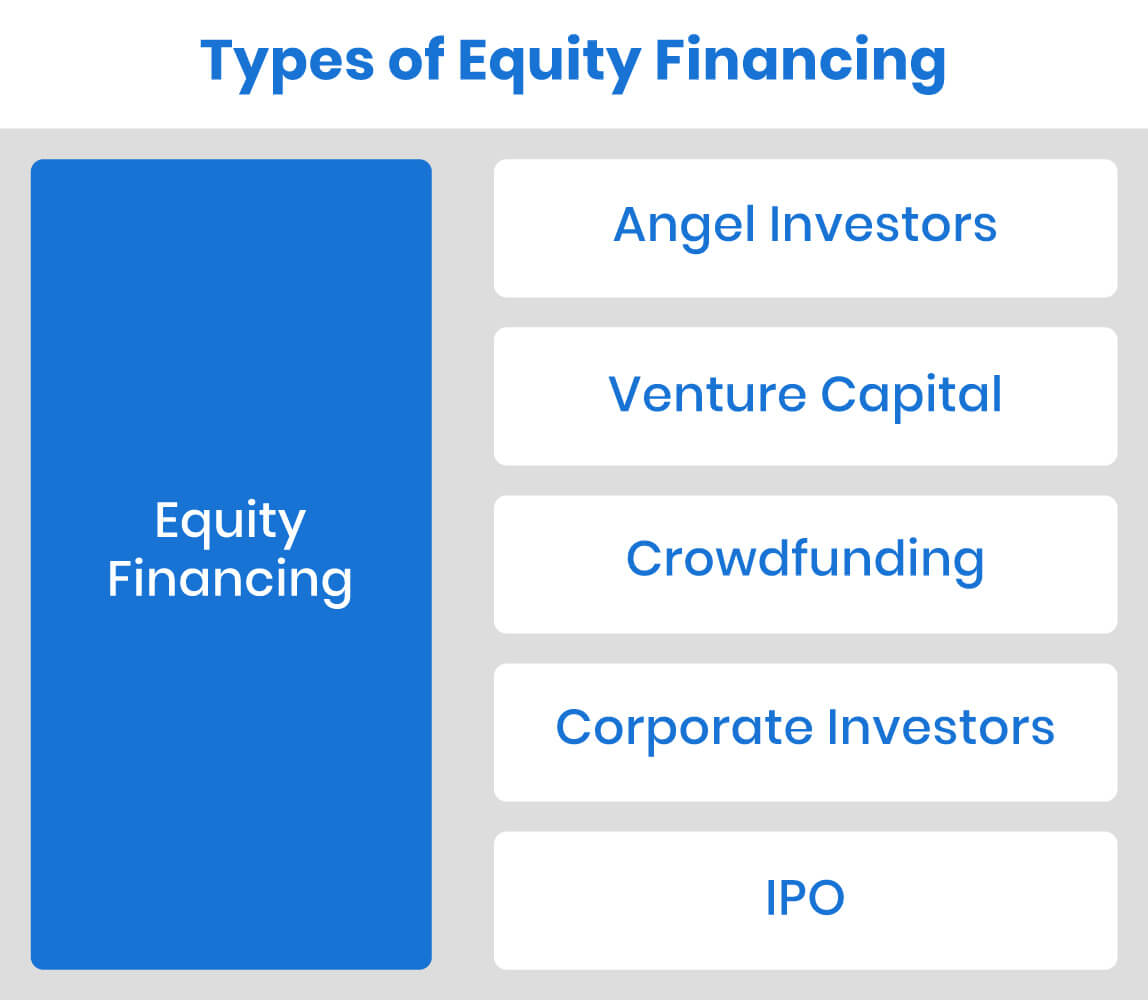

Types of Equity Financing

There are only two types of equity financing: Public and Private.

- Public equity financing: this includes initial public offerings, stock issues, and the sale of company held equity on the stock market. Publicly listed stock tends to be highly liquid, so even if it isn’t accepted as part payment in a transaction, the company could potentially sell equity that it holds to raise the required cash.

- Private equity financing: sometimes called a private placement, this is essentially the same as public equity financing with one major difference: the stock isn’t listed on a public exchange. That means that it is less liquid, but also faces less of the regulations that surround public equity listings.

Sources of Equity Financing

Having defined equity financing, the question then becomes:

‘Who would be interested in acquiring equity in my company?’

Even investors that claim to be industry agnostic often possess some restrictions about the kind of companies they invest in.

When these companies list the criteria that they’re looking for in investments on their websites, essentially what they’re doing is defining the criteria of the equity - as most will usually acquire part of the equity, rather than the whole business.

The following are the main sources of equity finance:

- Seed Capital Investors: Seed capital investors can range from incubation programs to private equity firms, and essentially refer to anybody that is willing to invest in a very early (often pre-revenue) stage company.

- Venture Capital Firms: Venture capital is early stage private equity. These investors usually seek high growth businesses, and accept higher risk in exchange for larger slices of equity. There is usually an experience imbalance (with the investors being more experienced in management than the company owners), so the equity investment will often have several stipulations around company management and strategy.

- Private Equity: Private equity has moved into the foreground in equity investing over the past two decades, with some estimates suggesting that industry will manage close to $6 trillion in assets by 2025 - 25% growth in just four years. The universe of private equity companies is now so large that, whatever your company’s size, there is likely to be a private equity company with the potential to provide equity financing.

- Crowdfunding: Crowdfunding received a major boost in 2012 with the passing of the JOBS Act, which aimed to encourage funding of small businesses in the United States by easing securities regulations. Now, companies can raise equity financing through a host of crowdfunding platforms, usually with a much broader base of investors (i.e., a crowd of investors) than more traditional forms of equity financing.

- Stock Market: As mentioned in the previous section, if your company has the relative luxury of being publicly listed, it can use its equity to raise financing on the public markets. Alternatively, if your company is private, if it meets certain criteria, it may be able to list on a public market through an IPO. Consider also a SPAC transaction (insert link), which have become widely popular in recent times.

Debt Financing vs. Equity Financing

When measuring whether your company should opt for debt or equity financing, there are a number of factors to consider.

As always, bear in mind that the comparisons made here are generalities and the specifics will depend on the prevailing market, your company, and the third parties involved in providing the finance.

This said, here are the main issues that you should consider when deciding which to choose for your company:

Repayment

Debt financing means that your company has to repay cash according to the terms agreed at the time of its issuing. If your company is unable to generate the cash required for repayment, this can become burdensome very quickly.

By contrast, equity financing just means that the provider of funds receives a share of the company and its profits.

And while this may seem more attractive in the short-term, in the long-term, depending on how much equity (i.e. what share of your company) is issued, it can work out to be far more expensive than debt financing.

Control

The bigger the funds required, the more terms and conditions will be attached. This is as true for debt financing as it is for equity financing.

On balance however, at least debt financing means that terms are only imposed for the duration of the loan being paid. With equity financing, the party that provided equity finance now holds a share of your company and by extension, some of the voting rights.

Depending on the terms agreed, they may even be able to influence your company’s strategy. All issues to ponder when considering the trade off between financing with debt or equity.

Note: While most articles of this kind take the narrative, ‘debt or equity’, we are keen to emphasize that your choice for financing doesn’t have to be one or the other.

There are hybrid options (i.e. combinations of the two) that may work out even better, particularly if you believe that your equity will be worth far more in the future.

Our recommendation is that you look at every option for financing available, including hybrid combinations of debt and equity.

Valuing Equity

If your company isn’t publicly listed, you will need to conduct a valuation of your company. This will allow you to arrive at an estimate for how much of its equity needs to be sold to obtain the required amount of funds.

In a previous article DealRoom looked at how to conduct a valuation of a private company and the challenges involved in doing so. There are several issues to consider with a valuation, including where the market is in its cycle.

Depending on what value the professionally conducted valuation provides for your business, it may be better to wait until your equity has a higher valuation before undertaking your company’s equity financing.

Useful resources:

How the Approach to Valuation Frames Success for Diligence and Integration

Intangible Asset Valuation: Methods from an Industry Pro

Avoiding Valuation Surprises and Accounting for M&A Transactions

Equity Financing: Advantages and Disadvantages

First, the advantages of equity financing:

- Private equity companies are sitting on record levels of ‘dry powder’ (i.e. capital waiting to be invested), so there’s never been a better time to seek equity financing.

- When markets are trading at historic highs, holders of equity have the potential to use equity to fund transactions that would otherwise require excessive amounts of cash.

- Equity financing tends to be a better option when interest rates are high, and debt financing becomes more expensive.

- If you raise equity financing with the right investment company, you may be able to benefit from their network and expertise.

- Raising equity financing with a high profile investment company (say, a blue chip private equity firm) is an excellent signalling mechanism for your company’s potential.

- Equity financing means none of the regular cash-sapping interest repayments that come with debt financing.

And the disadvantages of equity financing:

- The terms negotiated on your equity financing may hinder your company’s management from making growth-oriented decisions.

- In high-growth industries, or industries with uncertain futures, valuations can be challenging, opening the potential for undervaluing your company’s equity.

- The search for the right equity investor, combined with the time that it takes them to conduct due diligence on your company, can take several months.

- If relations sour with the equity investor after the equity financing, the investment may ultimately destroy value - negating the point of the investment in the first place.

- Dividing control of a company, particularly a private company, among several parties can make a sale of the company more challenging further down the road.

Using Equity Financing in M&A

As mentioned elsewhere in this article, all ten of the largest M&A transactions conducted this decade have involved some form of equity financing.

The biggest of these - the merger of S&P Global and IHS Markit in 2020 - was an all-equity affair, involving no cash or debt.

In the 9 or so months since the transaction, S&P Global’s share price has grown by over 25%, reflecting anecdotal evidence that it’s invariably a better idea to fund M&A transactions with equity when market valuations are looking frothy.

When considering whether to use equity financing for M&A, ask yourself honestly if you think your stock is a good buy at the current price. If the answer is ‘no’, it could provide you with a powerful weapon in an M&A transaction.

Equity Financing Due Diligence Checklist

1. Capital-Formation Strategy

- How much capital does the company really need, when does really need it, and whether there are alternative ways to obtain these resources?

- Do both parties have growth in company’s value once enter into an agreement?

- Is the deal structure going to 20% equity with 80% control or any other way? (or any other way)

- Is the chosen Capital Formation Strategy can mitigate risk or has downside protection?

- Obtain feedback on strengths and weaknesses from board members or other third parties.

- Comprehend the company's position against its public or private competitors by recognizing their public or private competitors.

- Asses the company's potential and how it fits into the investor's portfolio.

- Produce a tracking document/envieronment (to contact a lot of investors and process).

2. Preparing Confidential Info

- Make sure the business is on track with realistic and measurable goals, anticipating what is to come, reviewing the plan on a regular basis and revising if necessary.

- Brief history

- Mission and Vision Statement (why you are in this business)

- Discussion of your revenue and business model

- Overview of products and services

- Background of management team

- Key features of your market

- Summary of the company’s financial performance up to date

- How much money you need to raise and why?

- Organizational and management structure

- Operational and management policies

- Description of products and services (both current and anticipated)

- Overview of trends in the industry and marketplace in which the business compete (or plan to)

- Key strengths and weaknesses of the company

- Key products and services currently offered

- Proprietary features, strengths and weaknesses of each

- Anticipated products and services (how future product development and research will be affected by the financing you seek)

- The Role Your Business Plan Plays

- Prepapre a TOWS Analysis

- Strategies for reaching current and anticipated customers or clients

- Pricing policies and strategies

- Advertising and public-relations plans and strategic alliances

- Summary of financial performance for past three to five years

- Current financial condition (include recent Income Statements, Balance Sheets and Cashflows as attachments)

- Projected financial condition (present forecasts for three to five years)

- Discussion of working budgets and how capital will be allocated and used in accordance with these budgets will be extended.

3. Develop a Winning Pitch Deck

- Prepare a good summary than a lengthy discourse and piques the interest of potential investors.

- Problem - explains the market gap that needs to be filled in a way that people can relate to and investors can understand.

- Solution - needs to be concise, clear and scalable.

- Market - outline the past market, as well as future potential growth.

- Product or Services – in action

- Traction and Milestones - month over month growth of the business (e.g. revenue, metrics, etc).

- Team - describe the leadership’s team members.

- Competition – same-industry competitors

- Financials – 3- or 5-years performance and projections of the company

- Amount being raised - Instead of using specific amounts, consider using ranges of numbers.

4. Meetings and Immersion

- Present a brief and descriptive pitch deck

- Make a compelling narrative to share.

- Demonstrate your product or service's one-of-a-kind value.

- Present a solid and realistic data (with back ups)

- Describe your revenue strategy.

- Be prepared for any questions that may arise and be prepared to answer them in advance.

- Wrap it up

5. Creation of a Pro-Forma Cap Table

- Demonstrate the ownership and market value of the company both now and after a potential investment.

- Analyse the impact of investments, aftermath

- Identify the risks and rewards after a potential investment

To find a complete debt financing template visit our templates gallery and utilyze pre-built ready to use playbook. You can always customize it right inside the DealRoom to fit your needs.

Conclusion

The great thing about equity is that every company has it. The challenging part may be to convince investors that they want to give you money for it.

Equity financing brings a different set of considerations to debt financing, principally, understanding who you’re getting into business with.

ust as investors conduct due diligence on the companies that they invest in, those companies should conduct due diligence on the investors they’re giving part control of their company to.

Talk to DealRoom today about how our platform for M&A and services can help you through your equity financing process, and how we can improve the due diligence process of both sides of the transaction.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

.png)

.png)

.png)

.svg)

.png)