Enhanced Due Diligence for High Risk Customers

There are different categories of risk rating of customers under the Know Your Customer (KYC) principles.

These categories include high risk, high net worth, low risk or low net worth customers.

At DealRoom we help dozens of companies to organize their due diligence process and in this guide we'll explain what is enhanced due diligence and why it is important.

What is Enhanced Due Diligence (EDD)?

In simple definition, EDD was designed as processes and procedures to handle high risk customers and large financial transactions. The high risk categories are not necessarily considered as so because of the risk they pose to the financial bodies.

Why it is Important?

The importance of regulating the transactions of these individuals is a result of state based security consideration. The Bank Secrecy Act has led to the inception of EDD as a compulsory procedure by the Patriot Act of 2001.

The Patriot’s act required that private banking institutions, new overseas accounts, and correspondent accounts obey EDD laws and regulations.

These laws and regulations are considered to be robust since they require a significant amount of evidence and detailed information.

The entire EDD process must be well documented in detail, especially in the account opening and client risk assessment stages.

So regulators have access to the data that is handled by professional data analysts.

The documents gathered from this mined data is used for reporting suspicious activities, anti-money laundering policies and other irregular transactions. This is what financial institutions say about EDD.

What You Get with Enhanced Due Diligence

Enhanced due diligence, like customer due diligence (CDD), is a KYC process. With EDD, you are provided with a greater level of scrutiny from business partners. This helps detect risks that wouldn’t be detected by CDD.

Over all, the CDD process is not as strict and rigorous in its verification procedures when compared to the EDD process.

Also, EDD is required only for customers who are regarded as high risk based on the KYC’s rating system.

How Enhanced Due Diligence Works

Factors that Affect an Enhanced Due Diligence

EDD is an ongoing process that is affected by many outside factors including customer, geographical, and additional risk factors. Some of them are discussed below:

1. Customer Factors. The regulation of risk of any institution must be in compliance with the BSL AML laws. Risk factors can include situations where the bulk of customers are non-residents of the institution’s country of operation. There are also the tendencies of a customer or their relative being a politically exposed person.

2. Geographical Factors. Geographical factors, especially diplomatic relations play an important role in EDD. People from politically sanctioned countries will likely be classified as high risk customers when they want to make transactions. Also, locations with designated terrorists organizations operating within its borders will have its citizens placed as high risk customers.

3. Other risk factors. In the private, corresponding banking sector, there is high level of confidentiality. The industry is driven by revenue. As a result of this, they are prone to money laundering and terrorist financing.

When Must I Do Enhanced Due Diligence (EDD)

In the prevention of money laundering and terrorist financing, EDD has become the standard practice. EDD is required before any business relationship or deal can be reached between two parties.

This includes financial transactions or money deposits.

When you are looking forward to entering a business relationship with a new customer, they need to be identified and verified.

EDD being a one-time process will not require further identification and verification again unless some unforeseen events happen. These events will likely be any of the following:

- A change in the product or services that exists between you and your client

- Concerns are raised with regards to the validity of previous data collected

- For suspicion of money laundering or when there is a suspicious activity monitoring.

Enhanced due diligence (EDD) is therefore a practice that does not and should not stand still. Ongoing control should be carried out in order to collect the data needed to pick up trigger events.

This can prevent risk, or lead to a procedural changes and the amount of due diligence that needs to be collected.

With the development of the internet and FinTech, the database for financial sanctions is on the rise. Individuals and entities are constantly being added, updated or removed.

Their spending and source of funds are two main areas that need to be closely monitored. This has necessitated the need for monitoring and screening of customer details.

Enhanced Due Diligence Procedures

EDD procedures are handled by different professionals and it is a continuous ongoing monitoring procedure.

Nevertheless, the following steps are followed in carrying our enhanced due diligence:

Step 1: Start with a Risk-Based Approach

You will need to start by recognizing the high risk customers and separate them. Efficient classification is important for the understanding of your customers.

Step 2: Source for recognizing Information

Create a checklist for your AML BSL policies for high risk customers. This enhanced due diligence checklist provides all the needed details that concerns your client. If the CDD process has been done before, simply utilize part of data. You can also find extra details from third party analytics.

Step 3: Analyze the Source of Funds and Ultimate Beneficial Ownership (UBO)

You need to know the lawfulness of your customer’s source of funds. For effective analysis, you have to verify that the value of all the non-financial and financial assets of your customer correlates with his/her real assets.

Any inconsistencies between earnings, source of wealth and net worth should be addressed. The subsidiaries and shareholdings of entities must be checked in the determination of Ultimate Beneficial Ownership (UBO) of an organization/company.

Step 4: Ongoing Transactions Monitoring

If there is a customer’s transaction history available, it should be checked. Details such as transaction durations and parties involved should be thoroughly inspected. Ensure that these transactions are in tune with their stated purpose and in their expected threshold.

Step 5: Adverse Media and Negative Check

Review affiliated press articles and analyze pertinent information to build a full profile of your customer and their reputation. Negative results are an indicator that there are too many risks for the business.

Step 6: Conduct an On-site Visit

Conducting an on-site visit to the physical address is a necessary requirement for all legal entities including banks and companies. Documents that cannot be sourced digitally can be physically corroborated. A high risk is detected if the physical address does not correspond with the address on official documents.

Step 7: Draft Your Report and Develop Ongoing Monitoring Strategy

Consistently monitoring high risk customers is time consuming. In order to employ a risk-based monitoring strategy, you have to understand the essential parameters. You also have to set a periodic timetable to monitor and revise your data. Due to technology advances, the use of the software EDD approach can largely help with swift decision making.

A Few Tips for Successful Enhanced Due Diligence

In order to have a successful due diligence form, teams need to be organized and thorough. This includes keeping up with priorities and proper coordination.

Ongoing Monitoring should be a top priority

Adequate measures have to be put in place in order to detect suspicious transactions. The availability of artificial intelligence (AI) and machine learning (ML) has made this easier. A slight breach in policy or compliance can quickly be detected in a record.

Coordinate your information sharing

An institution’s compliances guide every customer transaction. The compliance team needs to be well informed of the various risks and processes that exist within your organization. This will enable them to detect violations easily and thus, enhance better EDD processes.

Develop a culture of compliance

Compliance in its entirety cannot be overemphasized in the management of high risk customers. There is need to develop a culture of compliance which will eliminate the risk of corruption within your company.

How DealRoom Can Help

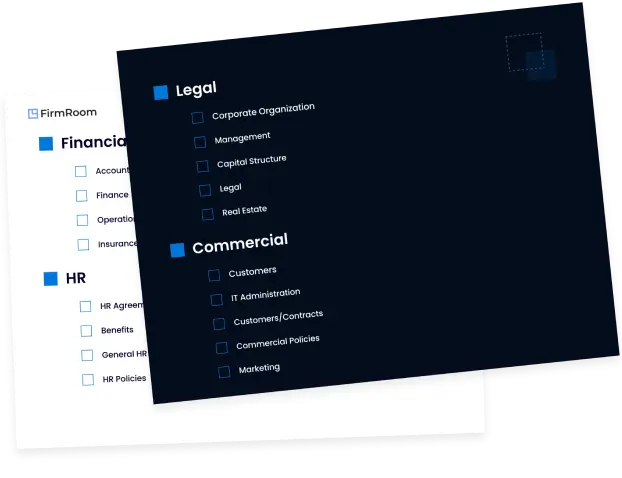

DealRoom’s due diligence software provides teams with a simple way to keep their enhanced due diligence checklist managed and organized.

Users can easily adjust priorities, fulfill tasks, and communicate with other users in the platform.

Are you ready for efficient EDD workflows?

Try DealRoom today.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

.jpg)

.png)

.png)

.png)

.svg)

.png)